Investments

As we first began doing in the 2020 Plan, UofL continues to measure our progress in sustainability based upon the Sustainability Tracking, Assessment & Rating System (STARS) developed by the Association for the Advancement of Sustainability in Higher Education (AASHE). The STARS framework stresses the influence of a university’s investment policies and strategies on social and environmental well-being and the importance of establishing an engaged, broadly-representative Committee on Investor Responsibility, making positive sustainability investments, and performing shareholder advocacy for greater social and environmental responsibility.

We have been aided in this effort and continue to seek opportunities to exchange ideas and information with other schools through the Intentional Endowments Network, Divest Ed, Freedom to Thrive, and the former Responsible Endowments Coalition.

UofL was one of two schools highlighted as having best practices for Investment Disclosure by the Sustainable Endowments Institute’s September 2014 Report:College Endowment Investment Trends and Best Practices: An Analysis of STARS Data

Investments held in UofL's endowment

UofL's endowment is managed by the UofL Foundation (ULF), which contracts with third parties to manage the investments. In 2020 ULF switched its contract to a 100% employee-owned and operated company, Prime Buchholz LLC, for investment consulting services. Prime Buchholz has helped ULF select lower carbon-intensity investment funds. They have been doing Environmental, Social & Governance (ESG) mission investing since 1988 and in 2016, they formalized it within their firm with a Socially Responsible Investing (SRI) Task Force with 25 committee members (out of about 125 employees). Prime Buchholz has their own rankings and in 2021 they had over 70 recommended ESG products (with 40+ in the pipeline). They are looking to find the highest ranked funds. An example is Generation Global, co-founded by Al Gore, which is an equity manager that picks stocks worldwide with low carbon footprint.

UofL's endowment is managed by the UofL Foundation (ULF), which contracts with third parties to manage the investments. In 2020 ULF switched its contract to a 100% employee-owned and operated company, Prime Buchholz LLC, for investment consulting services. Prime Buchholz has helped ULF select lower carbon-intensity investment funds. They have been doing Environmental, Social & Governance (ESG) mission investing since 1988 and in 2016, they formalized it within their firm with a Socially Responsible Investing (SRI) Task Force with 25 committee members (out of about 125 employees). Prime Buchholz has their own rankings and in 2021 they had over 70 recommended ESG products (with 40+ in the pipeline). They are looking to find the highest ranked funds. An example is Generation Global, co-founded by Al Gore, which is an equity manager that picks stocks worldwide with low carbon footprint.

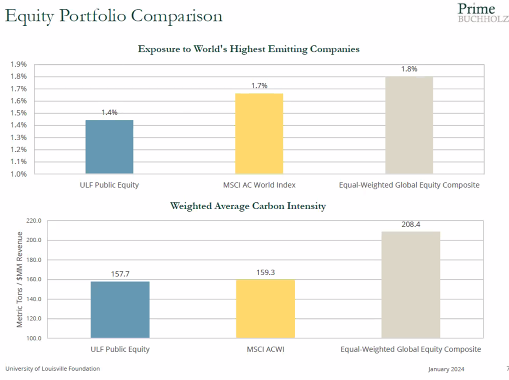

Prime Buchholz invests a lot of attention into trying to quantify fossil fuel exposure for clients like ULF by partnering with MSCI, a noted index provider and data collector. As of January 2024, they summarized ULF's fossil fuel exposure (the bulk of which is in Equities) as follows:

- ULF’s weighted average carbon intensity has fallen and risen back up over time from 131.5 (12/31/19) to 128 (9/30/20) to 157.7 Metric Tons / $MM Revenue (January 2024), compared to the average of 159.3 for MSCI’s ACWI (All Country World Index).

- ULF’s exposure to the world’s highest emitting companies (e.g. Exxon/Mobile, Duke Energy, etc.) increased slightly from 1.1% (9/30/20) to 1.4% (January 2024), but remained below the average of 1.7% MSCI ACWI.

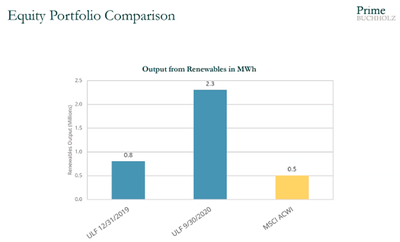

- Additionally, ULF’s output from renewables as a result of investment increased from 0.8 (12/31/19) to 2.3 megawatt-hours (MWh) (9/30/20), compared to 0.5 for MSCI's ACWI.

Portfolio Snapshots

At the request of the Sustainable Endowments Institute, we've posted snapshots of our investment portfolio, available online here.

The most recent snapshot reveals that, as of May 2022, the Foundation's account manager, Prime Buchholz, estimated that 7.4% of the total investment pool is in positive sustainability investments - i.e. about $54.7M in sustainability investment funds (including those that invest in companies which participate in wind turbine manufacturing, sustainable public transportation, sustainable building materials, renewable energy sources, and green technology development; and $18.2M in socially responsible mutual funds with positive screens (including funds that do not invest in fossil fuels, but global technology, software, services, and online sector companies that score high in ESG ratings and have exemplary corporate sustainability practices).

Prior Snapshots:

As of June 30, 2021, the Foundation's account manager, Prime Buchholz, estimated that 28.95% of the total investment pool is in positive sustainability investments - i.e. about $37M in sustainable industries (e.g. companies that are focused on large-scale hydroelectric, recycling, water and community development, including organics, industrial waste, water treatment and green building related companies); $205.6M in businesses selected for exemplary sustainability performance (companies that score high in ESG ratings and have exemplary corporate sustainability practices, or companies with sustainable business models and no harmful business practices such as polluting or harming the environment); and $2.5M in sustainability investment funds.

As of August 31, 2018, the Foundation's account manager at the time, Cambridge Associates, estimated that 19% of the total investment pool is in positive sustainability investments.

In September 2015, we estimated UofL's total mission-related investments at 1.85% of the University's total endowment. Most of these were community economic development funds, but also included are climate change equities. Funds included: Kentucky Seed Fund, Chrysalis II & III, Triathlon, and Capital South.

- UofL Foundation Publicly-Traded Holdings as of 6-30-2015

- UofL Foundation Hedge Fund Holdings as of 6-30-2015

- UofL Foundation Fixed Income Holdings as of 6-30-2015

- UofL Foundation Manager Holdings - (Publicly Traded) 9-30-2013

- UofL Foundation Manager Holdings - Hedge Funds (Long Only) 9-30-2013

In a previous reporting in September 2013, we had estimated UofL's total mission-related investments at 2.2% of the University's total endowment. Most of these were also community economic development funds and some climate change equities. In 2013, funds included: Kentucky Seed Fund, Chrysalis Ventures, Metro Bank CDs, Triathlon, Capital South, and Wellington DIH. At the time, the trend in UofL sustainability-related investments had been in a positive direction:

- Estimated value of holdings in sustainability investment funds, as of April 2010: $2,134,871.

- Estimated value of holdings in community development financial institutions, as of September 2013: $9,470,560

More information about the University's finances is available here.

In March 2015, UofL's primary financial services provider, PNC Bank, announced that it would no longer finance coal-mining companies that pursue the environmentally devastating practice of mountaintop removal mining in Appalachia. Read more.

Investment Policy

In January 2021, the University of Louisville Foundation added Section XII: Mission Aligned Investing to its Investment Policy Statement. It reads:

"When evaluating existing and prospective investments for the Fund, the Investment Office will consider the manager's impact on the Environmental, Social, Governance ("ESG") and Diversity, Equity, and Inclusion ("DEI") profile of the Fund. Investment managers will be appointed following a systematic search for those with demonstrated quality in the style desired. In considering investments with existing and potential managers, the Investment Office will consider the potential returns against the investment's potential to advance the overall mission of the University. The portfolio's investment objectives are long term and seek to maximize the Fund's positive impact by achieving targeted investment returns. The portfolio's investments will seek best efforts to align these objectives with mission-related considerations where the dual objectives can be met."

Shareholder Advocacy

UofL participates in shareholder advocacy through a contract with Glass Lewis that began July 2021. On August 24, 2022, Glass Lewis provided a training and orientation in shareholder advocacy for UofL’s Committee on Investor Responsibility using Viewpoint, which is Glass Lewis’ shareholder advocacy platform. Glass Lewis produces ESG scores (including Climate Risk Mitigation scores) for many companies and, through Viewpoint, users can access these ESG scores for all of the companies that the UofL Foundation is invested in.

The UofL Foundation signed up for Glass Lewis' ESG Voting Policy which includes the following guidelines for voting proxies (from January 2023 policy statement):

"Environmental and Social Oversight and Performance

The ESG Policy considers the oversight afforded to environmental and social issues. The ESG Policy looks to ensure that companies maintain appropriate board-level oversight of material risks to their operations, including those that are environmental and social in nature. When it is clear that these risks have not been properly managed or mitigated, the ESG Policy may vote against members of the board who are responsible for the oversight of environmental and social risks. In the absence of explicit board oversight of environmental and social issues, the ESG Policy may vote against members of the audit committee. In making these determinations, the ESG Policy will take into account the situation at hand, its effect on shareholder value, as well as any corrective action or other response made by the company.

Board-Level Oversight of Environmental and Social Risks

The insufficient oversight of environmental and social issues can present direct legal, financial, regulatory and reputational risks that could serve to harm shareholder interests. As a result, the ESG Policy promotes oversight structures that ensure that companies are mitigating attendant risks ad capitalizing on related opportunities to the best extent possible. To that end, the ESG Policy looks to boards to maintain clear oversight of material risks to their operations, including those that are environmental and social in nature. These risks could include, but are not limited to, matters related to climate change, human capital management, diversity, stakeholder relations, and health, safety & environment. Glass Lewis will review a company’s overall governance practices to identify which directors or board-level committees have been charged with oversight of environmental and/or social issues. Given the importance of the board’s role in overseeing environmental and social risks, the ESG Policy will vote against members of the governance committee that fails to provide explicit disclosure concerning the board’s role in overseeing these issues.

Climate Risk

Given the importance of companies mitigation and management of climate-related risks, the ESG Policy includes specific consideration for companies’ disclosure of and policies concerning climate change. For companies included in the Climate Action 100+ focus list and those that operate in industries where the Sustainability Accounting Standards Board (SASB) has determined that greenhouse gas (GHG) emissions represent a financially material risk, the ESG Policy will vote against the chair of the board in instances where a company has not adopted a net zero emissions target or ambition. For all other companies, the ESG Policy will vote against the chair of the board in instances where companies have not established any forward-looking GHG emissions reduction targets. In both instances, if the chair of the board is also the company’s CEO, the ESG Policy will vote against the chair of the audit committee. The ESG Policy also takes into consideration investors’ growing expectation for robust climate and sustainability disclosures. For Climate Action 100+ focus list companies, as well as those where SASB has determined that GHG emissions represent a material risk, the ESG Policy will vote against the chair of the board when the company has failed to produce reporting that is aligned with the recommendations of the Task force on Climate-related Financial Disclosures (TCFD). For all other companies, the ESG Policy will vote against the chair of the board when they have not produced reporting that is aligned with SASB or if they have not responded to the CDP’s climate survey.

Stakeholder Considerations

In order to drive long-term shareholder value, companies require a social license to operate. A lack of consideration for stakeholders can present legal, regulatory, and reputational risks. With this view, the ESG Policy will vote against the chair of the board in instances where companies who are not signatories or participants in the United Nations Global Compact (UNGC) or that have not adopted a human rights policy that is aligned with the standards set forth by the International Labour Organization (ILO) or the Universal Declaration on Human Rights (UDHR). For U.S. companies listed in the S&P 500 index, the ESG Policy will also evaluate whether companies have provided sufficient disclosure concerning their workforce diversity. In instances where these companies have not disclosed their full EEO-1 reports, the ESG Policy will vote against the nominating and governance chair."

From July 2016 through June 2021, UofL participated in shareholder advocacy through a contract with Institutional Shareholder Services (ISS) to help us manage our proxy voting at shareholder meetings. UofL’s Committee on Investor Responsibility examined the proxy voting guidelines available through ISS and decided that the package which most closely aligns with UofL's mission and goals is the Socially Responsible Investment (SRI) Proxy Voting Guidelines. UofL uses these guidelines to vote on all shareholder resolutions for companies in which we are directly invested.

Committee on Investor Responsibility

In fall 2016, UofL formed a new Committee on Investor Responsibility (CIR) with broad representation from UofL students, faculty, staff, and Foundation representatives. While the committee is open to participation from all, the Provost's Office sends members an official letter of appointment with the the committee's charge at the start of each academic year. The most recent charge from the Provost on August 4, 2023 was as follows:

"The committee is asked to continue its work on and offer advice to the University and the University of Louisville Foundation around the following:

- Supporting our Student Sustainability Fund as a learning opportunity with real-world impact for students to practice applying sustainability principles to both investment and philanthropy.

- Shareholder proxy voting that best fits the goals of the institution.

- Determining whether and under what conditions we should be initiating shareholder resolutions.

- Developing a sustainable investment policy."

Those interested in participating in the Committee on Investor Responsibility should contact the Chairs, James Lechleiter and Xudong Fu .

Student-Managed Socially-Responsible Investment Fund

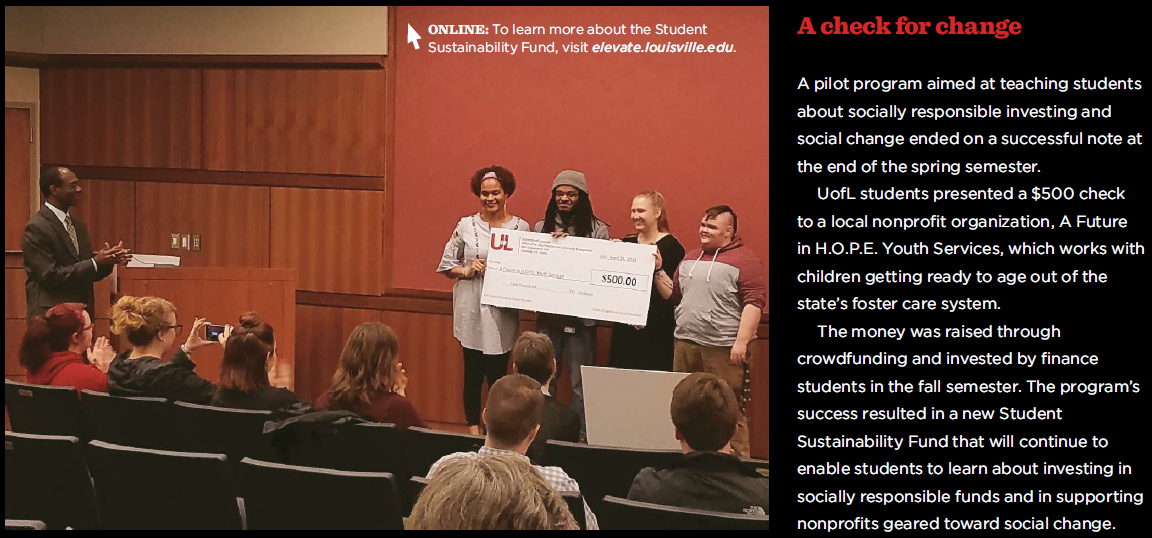

In 2017-18, UofL piloted a new, full-circle, Student Sustainability Fund through which students in a fall Finance class learn about and gain real-world experience with Socially-Responsible Investing during the fall semester; and then, in the spring semester, students in a Social Change class learn about and gain real-world experience with Student Philanthropy to support local projects and organizations working to implement sustainability.

On April 6, 2018, UofL launched an Arbor Day to Earth Day crowdfunding campaign to create the new Student Sustainability Fund. From April 6-22, 2018, friends of UofL were encouraged to help us unlock a donor match: When we raise $5,000 for the Student Sustainability Fund, Just Money Advisors, a Louisville-based company, pledged to give $5,000 towards the fund! Gifts of all sizes help unlock this matching gift. By supporting the Student Sustainability Fund you are investing in high-value, hands-on education for 21st century social responsibility. The SSF is a unique fund, separate from the rest of the endowment, which uses the fund itself as a pedagogical tool. First, Finance students in the College of Business do some real-world socially responsible investing by selecting funds, investing real dollars, managing the fund, and voting their proxies. All investments and proxy votes will be researched and selected by students, subject to the university’s sustainable investments policy. Then, Social Change students in the College of Arts & Sciences use the proceeds to fund local nonprofit or philanthropic projects either on or off campus. They research local nonprofits and allocate funds in a way that builds capacity or enhances sustainability. Thus the Student Sustainability Fund puts donors’ resources directly to work for educational enrichment and social change. Donate today!

In Spring 2021, small groups within Professor Cherie Dawson-Edwards' Social Change course researched a variety of local non-profits to potentially support through the Student Sustainability Fund. They presented their cases to the class and the students ultimately voted to support Change Today Change Tomorrow, a Black woman led non-profit organization that works for positive change in three vital areas: 1. Education - combating racist educational structures by providing alternative education to our marginalized youth! 2. Food Justice - providing access to fresh and organic foods to improve health and wellness in marginalized communities; and 3. Public Health - from outreach for the unhoused to providing period products to community organizations, they are assessing needs and filling voids.

In Spring 2020, unfortunately, the onset of the COVID 19 pandemic disrupted plans for a student philanthropy project.

In Spring 2019, small groups within the class researched a variety of local non-profits and presented their cases. The full class voted to support The Bail Project-Louisville, the local arm of the national project to end cash bail and support those who are being kept behind bars simply due to poverty.

In Spring 2018, students in the class selected the inaugural beneficiary of the Student Sustainability Fund: A Future In H.O.P.E. Youth Services, a local non-profit organization dedicated to housing and mentoring youth who are in the state's custody and getting ready to age out of the foster care system.

Socially-Responsible Retirement Funds

UofL offers employees socially-responsible investment options for employee retirement plans. These options are designed to give you investment income for a secure retirement while putting money behind companies you can feel good about. Options include:

- CREF Social Choice Account. Investing in companies that are: strong stewards of the environment, devoted to serving local communities, committed to higher labor standards, and managed ethically. More information available online here.

- TIAA-CREF Social Choice Equity Fund. The fund's investments are subject to certain environmental, social and governance criteria. The evaluation process favors companies that are strong stewards of the environment; devoted to serving local communities; committed to higher labor standards; dedicated to producing high-quality and safe products; and those managed in an exemplary or ethical manner. More information available online here.

- Fidelity Environment and Alternative Energy Portfolio (FSLEX). Investing primarily in companies engaged in business activities related to alternative and renewable energy, energy efficiency, pollution control, water infrastructure, waste and recycling technologies, or other environmental support services. More information available online here.

To learn more, we recommend the Intentional Endowment Network's Guide to Sustainable Retirements. More information about UofL's employee benefits and our human resources policies are available here.

Invest Your Values - In order to align investments with values, investors must first know what they own. But since most investment portfolios and retirement plans rely heavily on mutual funds, it is nearly impossible for investors to know what individual companies they actually own. But now that’s changed. As You Sow’s Invest Your Values free online tools screen mutual fund holdings against specific environmental, social, and governance issues. Mutual fund investors can know what they own, and can align their investments with their values.

2010-12 Committee on Socially Responsible Investing

In November 2010, former Provost Willihnganz charged a new university-wide Committee on Socially Responsible Investing (SRI) with making recommendations to the President and Provost on financially, socially and environmentally responsible investment opportunities across asset classes and other related recommendations as appropriate, including shareholder advocacy and proxy voting.

The Committee had multi-stakeholder representation and provided a structure for fostering dialogue on investment opportunities, and helping the UofL Foundation make responsible investments that ensure financial health for UofL while promoting sustainability in the wider world. The Committee researched investment opportunities that would compliment the University’s mission, its resource requirements, and its commitment to sustainability.

The committee's recommendations were approved by the administration in June 2012, as follows:

- Establish a permanent Socially Responsible Investment Advisory Committee – the establishment of such a committee should move forward immediately and its first task should be to develop a policy for proxy voting. The Provost agreed to work with appropriate parties to appoint members.

- Contract with a qualified service to make recommendations for UofL investment proxy voting to promote sustainability; and

- Adopt a broad policy statement for proxy voting.