COVID-19 Unemployment FAQs

During this difficult time, we understand you have important questions that need to be answered. We have developed this site so we can capture all the questions you have regarding unemployment. Please know that we are committed to getting ALL the answers to your questions. As we receive answers we will document them here. If you need additional financial assistance, please remember the Staff Help Assistance Relief Effort (SHARE) program.

ANNOUNCEMENTS:

- If you received a notification regarding unemployment fraud or suspect unemployment fraud on your account, visit our Kentucky Unemployment Fraud Information webpage for guidance.

- Learn more about updates regarding unemployment benefits and tax withholdings as well as the 1099-G FAQs.

- Read the latest update regarding your Bank of America UI debit card!

- Review the latest Executive Order from Gov. Beshear

The Internal Revenue Service (IRS) announced that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. There is no need for taxpayers to file an amended return unless the calculations make the taxpayer newly eligible for additional federal credits and deductions not already included on the original tax return. The IRS has worked with the tax return preparation software industry to reflect these updates so people who choose to file electronically simply need to respond to the related questions when electronically preparing their tax returns.

Pending Unemployment Questions

These questions were sent to the unemployment office on your behalf. We will document the answer below, as soon as we receive a response. Thank you for your continued patience during this difficult time.

*There are currently no pending questions.

Answered Unemployment Questions

1. Why am I getting a confirmation notification stating, "Return to this website to claim your next eligible weeks between DATE (Sunday) to DATE (Friday)?"

According to the Kentucky unemployment office, "There is a glitch in the unemployment software system that gives you the wrong date. You should continue to request benefits weekly and you will receive a letter in the mail for each e-claim week advising you to continue to claim weekly." (Answered by the UI office 5.19.20)

2. On my claim page I have a KEWES validation message that states, "The 13-day employer protest period has not expired since your claim was filed on 5/11/20. You may request your check on 5/24/2020." What should I do (or what does this mean)?

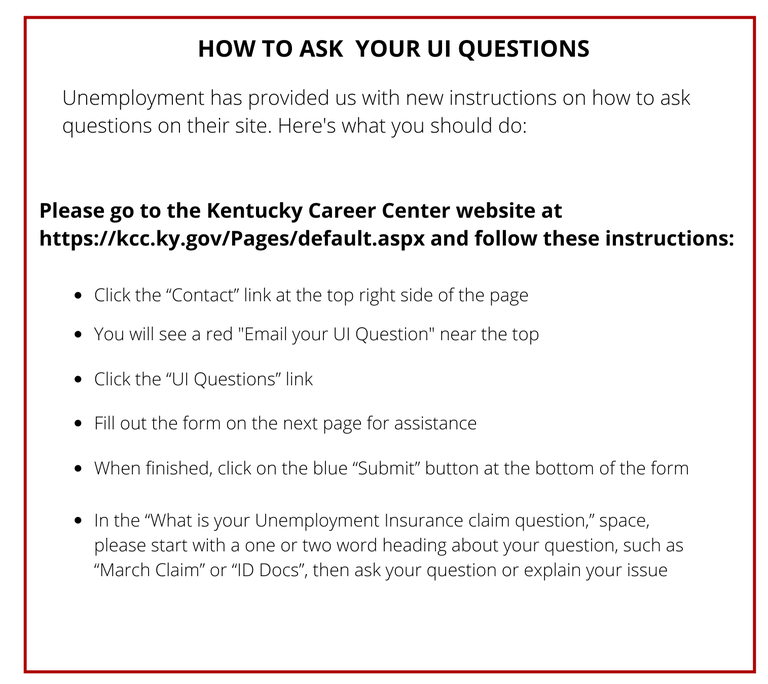

According to the unemployment office, the ""13 Day error message and/or return in 13 days to claim benefits” message can be seen for multiple reasons. The most likely reasons are 1) the claimant tried to request benefits after the request period or 2) they have already requested benefits for that week and the new file for the current week is waiting to be run." You must notify them directly. Please refer to the “How to Ask Your UI Questions” below for the new instructions on how to submit your question. (Answered by the UI office 6.9.20)

3. Do I have to request payments from unemployment office each week of my furlough period?

Yes. The furlough letter you receive will outline the specific dates you should request benefit payments during your furlough period. (answered by UI office in early May)

4. How do I request unemployment benefits for 4 furlough days (Monday – Thursday) in the week that I return to work on a Friday?

You should request benefits for Monday – Thursday of the week that you return. You must also report wages earned for the Friday of the week you returned since you will be working and earning wages on that day. If the Friday you return to work is a holiday, you must still report the holiday pay as wages earned for that week. (answered by HR in early May)

5. My furlough letter tells me to choose “Benefits Request and Eligibility” but I don’t see that option. The only thing I see is “Request Payment” option. What should I do?

It appears the unemployment office has been updating their website. So, if “Request Payment” is an option, it is appropriate to choose it. (Answered by HR 5.19.20)

6. If an employee only works one day in a workweek, are they still eligible for the $600 federal payment?

UofL cannot determine if anyone is eligible for unemployment benefits. However, according to the Kentucky unemployment website, anyone who is otherwise eligible for Unemployment Insurance is eligible and will receive the $600 CARES Act weekly payment. (Answered by the UI office 5.19.20)

7. Are unemployment insurance benefits considered taxable income by the Internal Revenue Service and the Kentucky Department of Revenue?

Unemployment insurance is considered taxable income. Please refer to the KY Unemployment website for further information. (answered by UI office in early May)

8. Since the University is filing an eclaim on our behalf, can I choose to have taxes withheld from my unemployment benefits?

Since the University is filing an eclaim, it will bypass the process of asking you to choose how you want taxes withheld and the system will default to not withholding taxes. However, if you want to change your withholding designation, please complete this form and send it to this mailing address:

Office of Unemployment Insurance

500 Mero Street, 4th Floor

Frankfort, Ky 40601(answered by UI office in early May)

9. Will I receive one or two payments from the Kentucky unemployment office if I qualify for unemployment?

The $600 will be a separate deposit that will likely be made a few days after you receive your unemployment payment from KY. For further information, visit https://kcc.ky.gov/Pages/COVID19-UI-Frequently-Asked-Questions.aspx. (answered by UI office in early May)

10. How long is the current federal $600 a week supplement for unemployed benefit slated to run?

The federal program has been extended to July 25, 2020. (answered by UI in early May)

11. If I want to enroll in direct deposit, (rather than the debit card) how far in advance can I do that? Can I set up an account prior to our first day of requesting a payment?

If you would like to enroll in direct deposit, please do so at the time you are requesting your first benefit payment. The furlough letter you receive outlines the exact date(s) you should request your first benefit payment. When you log into your UI account, there is an option that says “Payment Method.” (answered by UI office in early May)

12. I believe my weekly benefit rate is incorrect or I am not receiving the full $600 federal supplement, what should I do?

Unfortunately we have been unsuccessful with requesting specific information regarding our employee’s claim status from the Unemployment Office. We advise you call the Kentucky Employment Office at 502-564-2900 to discuss the specific details of their determination. Also, please remember that the Staff Senate has a SHARE program that grants up to $1000 to staff who impacted by our current circumstances. The link to their site is https://louisville.edu/staffsenate/documents/share-guidelines-4-22.20. (answered by HR in early May)

13. I received my first unemployment check, but have not received any other checks since then- what do I need to do?

Based on the Governor's ongoing news conferences regarding COVID-19, HR has learned that there is a back log for payments. As of May 22nd, there were still 14,000 March claims and 38,000 April claims which still need to be processed manually. Please remember that the Staff Senate has a SHARE program that grants up to $1000 to staff who impacted by our current circumstances. The link to their site is https://louisville.edu/staffsenate/documents/share-guidelines-4-22.20. (answered by HR 6.2.20)

14. I was denied unemployment insurance in Kentucky because most of my previous work experience, during the last 18 months, was in Indiana. Will the university be filing on my behalf in Indiana?

The university filed mass E-Claims in Kentucky on behalf of our employees, but, unfortunately, Indiana does not offer the same program. Therefore, you will need to file with the Indiana unemployment office.

15. I've been denied unemployment benefits, what should I do?

Unfortunately we have been unsuccessful with requesting specific information regarding our employee’s claim status from the Unemployment Office. We advise you call the Kentucky Employment Office at 502-564-2900 to discuss the specific details of their determination. Also, please remember that the Staff Senate has a SHARE program that grants up to $1000 to staff who impacted by our current circumstances. The link to their site is https://louisville.edu/staffsenate/documents/share-guidelines-4-22.20. (Answered by HR 5.19.20)

16. For people who were hired within the past year, what will they need to do to have income from previous employer(s) factored into unemployment? What if some of that income is from out of state?

According to the unemployment office, if someone was employed with another employer in Kentucky, those wages should be pulled to the employee’s claim automatically. The exception would be self-employment or a not-for-profit entity. If the wages were earned in another state, the unemployment office can attempt to request those be added to the employees’ claim here. (answered by UI office in early May)

17. I want to change my name in the unemployment system, how do I do that?

You will need to provide legal documentation. Please log into your account, go to Document Upload, and upload a PDF or photo format of 2 forms of verification of your current name (State issued ID, Driver’s License, Social Security Card, Birth Certificate, Marriage/Divorce Decree, Passport or Military ID). Once the documentation has been uploaded, your file will be updated as soon as possible. (answered by UI office in early May)

18. I filed my unemployment claim and opted for direct deposit into my bank account. The first week I received direct deposit, but after that, I received a debit card in the mail. What am I supposed to do with the debit card?

An employee reported that she didn’t activate her debit card, and a week later her payment was received through direct deposit. (answered by HR 5.27.20)

19. After logging into the unemployment system to request benefits, I received the following message, “Cannot find employer or address.” What should I do?

According to the unemployment office, when you receive this message you must notify them directly. Please refer to the “How to Ask Your UI Questions” below for the new instructions on how to submit your question. (answered by UI Office on 5.20.20)

20. While trying to request benefits, I received a message saying, "Your request for unemployment insurance benefits have been received for weeks up to (DATE) and the system is not allowing me to request benefits for this week." How do I request my benefits? Will this impact my $600 supplemental payment? (Sent 6.1.20)

The unemployment office has notified us they are aware of the messages that some of you may have received while attempting to request your benefits. These messages, in summary, state that they have already received your request for benefits. This message is incorrect and requires them to have to reset the file overnight. As such, the unemployment office has informed us that beginning tomorrow, Thursday, June 4, 2020 at 7 a.m. through Friday, June 5, 2020 at 7 p.m., you will be able to request your benefits. (answered by UI Office on 6.3.20)

21. While requesting benefits, the unemployment system asks me the question, “Are you returning to full-time work during the week?” Since I will be returning to work during a week I am on furlough Monday-Thursday and my first day back to work is the Friday of the same week, how should I respond? Should I respond yes or no to this question? (Sent 5.19.20)

If the employee is returning to permanent, full time work on an ongoing basis and do not anticipate needing unemployment benefits in the future, they should answer the question "Yes." If they anticipate working reduced hours in future weeks, they should answer "No." (answered by UI Office on 6.3.20)

22. How can I make changes to the responses I provided on the unemployment benefits form I filled out? (Sent 6.15.20)

According to the UI office, once responses are submitted, employees cannot change their response and will need to contact the UI office directly. Please refer to the “How to Ask Your UI Questions” below for the new instructions on how to submit your question. (answered by UI Office on 6.17.20)

23. I received a message stating, “An issue with your claim has been detected.” What should I do? (Sent 6.10.20 & 6.16.20)

According to the UI office, this message means that a security question was answered incorrectly. In order to be “cleared” for payment, you must contact the UI office. Please refer to the “How to Ask Your UI Questions” below for the new instructions on how to submit your question. (Answered by the UI office 6.26.20)

24. I missed the window to request benefits. What do I need to do to receive payment for the missed week? If my request window was missed, does it delay the CARES Act $600 payment? (Sent 6.10.20 & 6.16.20)

According to the UI office, if you've missed your window to request benefits, you will need to contact the HR Team at hrbpsvcs@louisville.edu so we can send your information to the UI office for review. Once reviewed, pay forms will be sent to your email address on file with us. When you are cleared by the UI office, you will receive your state UI payment and then your federal CARES Act $600 payment 1-2 days later. (Answered by the UI office 6.26.20)

25. If an employee is returning to work in the middle of the week, can they still request benefits for the days not worked that week? (Sent 6.29.20)

Yes, the individuals would report their wages when requesting their benefits. If 80% of their gross wages are lower than the weekly benefit amount, then they’d get the difference PLUS federal CARES benefits. If 80% of gross wages are higher than weekly benefit amount, then no benefits will be provided. (Answered by the UI office 6.30.20)

26. How are UI benefits calculated? How many quarters are used to determine benefits? Can someone appeal the determination even after they have received their benefit payments? (Sent 6.29.20)

Unemployment benefits are calculated using the 4 quarters prior to the employees last quarter. For example: If an employee files after April 2020, Q1 of 2020 will not be used in the calculation, and Q1-Q4 of 2019 is used in the calculation. If an employee files in March 2020, Q4 of 2019 is not used in the calculation, and Q4 of 2018 and Q1-Q3 of 2019 is used in the calculation. Contesting is acceptable if individuals can prove additional wages. (Answered by the UI office 6.30.20)

27. I received a message stating my benefit request cannot be completed because I have already requested benefits on July 4, 2020. What am I supposed to do? (Sent 7.12.20)

According to the UI office, this message is a system error. You will need to continue to request benefits weekly and contact the HR Team at hrbpsvcs@louisville.edu so we can send your information to the UI office for review. When you are cleared by the UI office, you will receive your state UI payment and then your federal CARES Act $600 payment 1-2 days later. (Answered by the UI office 7.13.20)

28. How long will it take to receive my benefit payments?

On average, it takes about 10-13 days for you to receive your unemployment benefit payment. Please know the length of time may vary depending on your individual circumstances. (answered by HR 7.27.20)

29. I received a $360 direct deposit this week and I am not currently furloughed, what is this?

The Office of Unemployment Insurance is currently processing payments under the FEMA Lost Wages Assistance program. Claimants for weeks ending August 1, August 8, and August 15 with a weekly benefit amount of $100 or more who are unemployed, partially unemployed, or unable or unavailable to work due to disruptions caused by COVID-19 may be eligible for a supplemental $400 payment. If you believe you are qualified to receive this payment and have not previously provided a certification that you are unemployed, partially unemployed, or unable or unavailable to work due to disruptions caused by COVID-19, you will need to log into your claim and provide this certification before your eligibility can be determined. According to our UI contact, there should be additional information provided via press release and/or mass email related to the LWA payments. Within this communication, the UI Office will provide additional guidance on the assistance program (answered by the UI office 9.25.20)

30. What is the LWA and how do I know if I qualify?

If you believe you qualify for the $400 federal payment and haven’t received it, click here to view your options. The last day to provide the self-certification for consideration of eligibility for the Lost Wages Assistance is Friday, October 16, 2020. If the self-certification screen does not pop up when you log into your account, you have already provided the certification or do not qualify monetarily. (answered by the UI office 10.15.20)

31. What is the process for filing taxes if I have claimed unemployment benefits this year?

If you received unemployment benefits, you will need to file taxes with the Internal Revenue Service (IRS). 1099-G documents for the year 2020 are in the process of being mailed out to over 600,000 claimants and the document has been added to your UI account. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received in 2020. A 1099-G is a tax form from the IRS showing the amount of refund, credit, or interest issued to you in the calendar year filing from your individual income tax returns. Click here to view 1099G Frequently Asked Questions and find additional assistance. (answered by the UI office 01.27.21)

If you have additional unanswered questions which are not listed here, please visit Kentucky's Unemployment FAQs and HR FAQs.

![]()

If you would like to submit an unemployment process question, please submit screenshots if possible. Submit these questions and screenshots to Human Resource Business Partners at hrbpsvcs@louisville.edu