Chapter VII: Big Men and Little Business

Illustration from Harper's Weekly December 20, 1913 by Walter J. Enright

J. P. Morgan & Co. declare, in their letter to the Pujo Committee, that "practically all the railroad and industrial development of this country has taken place initially through the medium of the great banking houses." That statement is entirely unfounded in fact. On the contrary nearly every such contribution to our comfort and prosperity was "initiated"withouttheir aid. The "great banking houses" came into relation with these enterprises, either after success had been attained, or upon "reorganization" after the possibility of success had been demonstrated, but the funds of the hardy pioneers, who had risked their all, were exhausted.

This is true of our early railroads, of our early street railways, and of the automobile; of the telegraph, the telephone and the wireless; of gas and oil; of harvesting machinery, and of our steel industry; of textile, paper and shoe industries; and of nearly every other important branch of manufacture. Theinitiationof each of these enterprises may properly be characterized as "great transactions"; and the men who contributed the financial aid and business management necessary for their introduction are entitled to share, equally with inventors, in our gratitude for what has been accomplished. But the instances are extremely rare where the original financing of such enterprises was undertaken by investment bankers, great or small. It was usually done by some common business man, accustomed to taking risks; or by some well-to-do friend of the inventor or pioneer, who was influenced largely by considerations other than money-getting. Here and there you will find that banker-aid was given; but usually in those cases it was a small local banking concern, not a "great banking house"' which helped to "initiate" the undertaking.

Railroads

We have come to associate the great bankers with railroads. But their part was not conspicuous in the early history of the Eastern railroads; and in the Middle West the experience was, to some extent, similar.

The Boston & Maine Railroad owns and leases 2,215 miles of line; but it is a composite of about 166 separate railroad companies. The New Haven Railroad owns and leases 1,996 miles of line; but it is a composite of 112 separate railroad companies. The necessary capital to build these little roads was gathered together, partly through state, county or municipal aid; partly from business men or landholders who sought to advance their special interests; partly from investors; and partly from well-to-do public-spirited men, who wished to promote the welfare of their particular communities. About seventy-five years after the first of these railroads was built, J. P. Morgan & Co. became fiscal agent for all of them by creating the New Haven-Boston & Maine monopoly.

Steamships

The history of our steamship lines is similar. In 1807, Robert Fulton, with the financial aid of Robert R. Livingston, a judge and statesman—not a banker— demonstrated with the Claremont, that it was practicable to propel boats by steam. In 1833 the three Cunard brothers of Halifax and 232 other persons—stockholders of the Quebec and Halifax Steam Navigation Company—joined in supplying about $80,000 to build the Royal William, the first steamer to cross the Atlantic. In 1902, many years after individual enterprises had developed practically all the great ocean lines, J. P. Morgan & Co. floated the International Mercantile Marine with its $52,744,000 of 4 1/2 bonds, now selling at about 60, and $100,000,000 of stock (preferred and common) on which no dividend has ever been paid. It was just sixty-two years after the first regular line of transatlantic steamers—the Cunard—was founded that Mr. Morgan organized the Shipping Trust.

Telegraph

The story of the telegraph is similar. The money for developing Morse's invention was supplied by his partner and co-worker, Alfred Vail. The initial line (from Washington to Baltimore) was built with an appropriation of $30,000 made by Congress in 1843. Sixty-six years later J. P. Morgan & Co. became bankers for the Western Union through financing its purchase by the American Telephone & Telegraph Company.

Harvesting Machinery

Next to railroads and steamships, harvesting machinery has probably been the most potent factor in the development of America; and most important of the harvesting machines was Cyrus H. McCormick's reaper. That made it possible to increase the grain harvest twenty- or thirty-fold. No investment banker had any part in introducing this great business man's invention.

McCormick was without means; but William Butler Ogden, a railroad builder, ex-Mayor and leading citizen of Chicago, supplied $25,000 with which the first factory was built there in 1847. Fifty-five years later; J. P. Morgan & Co. performed the service of combining the five great harvester companies, and received a commission of $3,000,000. The concerns then consolidated as the International Harvester Company, with a capital stock of $120,000,000, had, despite their huge assets and earning power, been previously capitalized, in the aggregate, at only $10,500,000—strong evidence that in all the preceding years no investment banker had financed them. Indeed, McCormick was as able in business as in mechanical invention. Two years after Ogden paid him $25,000 for a half interest in the business, McCormick bought it back for $50,000; and thereafter, until his death in 1884, no one but members of the McCormick family had any interest in the business.

The Banker Era

It may be urged that railroads and steamships, the telegraph and harvesting machinery were introduced before the accumulation of investment capital had developed the investment banker, and before America's "great banking houses" had been established; and that, consequently, it would be fairer to inquire what services bankers had rendered in connection with later industrial development. The firm of J. P. Morgan & Co. is fifty-five years old; Kuhn, Loeb & Co. fifty-six years old; Lee, Higginson & Co. over fifty years; and Kidder, Peabody & Co. forty-eight years; and yet the investment banker seems to have had almost as little part in "initiating" the great improvements of the last half century, as did bankers in the earlier period.

Steel

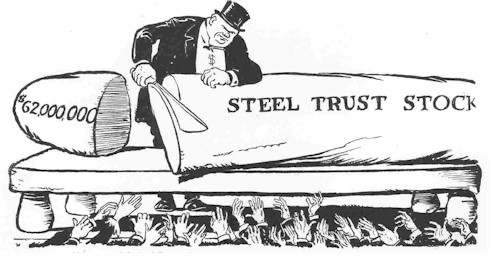

The modern steel industry of America, is forty-five years old. The "great bankers" had no part in initiating it. Andrew Carnegie, then already a man of large means, introduced the Bessemer process in 1868. In the next thirty years our steel and iron industry increased greatly. By 1898 we had far outstripped all competitors. America's production about equalled the aggregate of England and Germany. We had also reduced costs so much that Europe talked of the "American Peril." It was 1898, when J. P. Morgan & Co. took their first step in forming the Steel Trust, by organizing the Federal Steel Company. Then followed the combination of the tube mills into an $80,000,000 corporation, J. P. Morgan & Co. taking for their syndicate services $20,000,000 of common stock. About the same time the consolidation of the bridge and structural works, the tin plate, the sheet steel, the hoop and other mills followed; and finally, in 1901, the Steel Trust was formed, with a capitalization of $1,402,000,000. These combinations came thirty years after the steel industry had been "initiated".

The Telephone

The telephone industry is less than forty years old. It is probably America's greatest contribution to industrial development. The bankers had no part in "initiating" it. The glory belongs to a simple, enthusiastic, warm-hearted, business man of Haverhill, Massachusetts, who was willing to riskhis ownmoney. H. N. Casson tells of this, most interestingly, in his "History of the Telephone":

"The only man who had money and dared to stake it on the future of the telephone was Thomas Sanders, and he did this not mainly for business reasons. Both he and Hubbard were attached to Bell primarily by sentiment, as Bell had removed the blight of dumbness from Sanders' little son, and was soon to marry Hubbard's daughter. Also, Sanders had no expectation, at first, that so much money would be needed. He was not rich. His entire business, which was that of cutting out soles for shoe manufacturers, was not at any time worth more than thirty-five thousand dollars. Yet, from 1874 to 1878, he had advanced nine-tenths of the money that was spent on the telephone. The first five thousand telephones, and more, were made with his money. And so many long, expensive months dragged by before any relief came to Sanders, that he was compelled, much against his will and his business judgment, to stretch his credit within an inch of the breaking-point to help Bell and the telephone. Desperately he signed note after note until he faced a total of one hundred and ten thousand dollars. If the new 'scientific toy' succeeded, which he often doubted, he would be the richest citizen in Haverhill; and if it failed, which he sorely feared, he would be a bankrupt. Sanders and Hubbard were leasing telephones two by two, to business men who previously had been using the private lines of the Western Union Telegraph Company. This great corporation was at this time their natural and inevitable enemy. It had swallowed most of its competitors, and was reaching out to monopolize all methods of communication by wire. The rosiest hope that shone in front of Sanders and Hubbard was that the Western Union might conclude to buy the Bell patents, just as it had already bought many others. In one moment of discouragement they had offered the telephone to President Orton, of the Western Union, for $100,000; and Orton had refused it. ‘What use,’ he asked pleasantly, ‘could this company make of an electrical toy?’

"But besides the operation of its own wires, the Western Union was supplying customers with various kinds of printing-telegraphs and dial-telegraphs, some of which could transmit sixty words a minute. These accurate instruments, it believed, could never be displaced by such a scientific oddity as the telephone, and it continued to believe this until one of its subsidiary companies—the Gold and Stock—reported that several of its machines had been superseded by telephones.

"At once the Western Union awoke from its indifference. Even this tiny nibbling at its business must be stopped. It took action quickly, and organized the ‘American Speaking-Telephone Company,’ and with $300,000 capital, and with three electrical inventors, Edison, Gray, and Dolbear, on its staff. With all the bulk of its great wealth and prestige, it swept down upon Bell and his little body-guard. It trampled upon Bell's patent with as little concern as an elephant can have when he tramples upon an ant's nest. To the complete bewilderment of Bell, it coolly announced that it had the only original telephone, and that it was ready to supply superior telephones with all the latest improvements made by the original inventors—Dolbear, Gray, and Edison.

"The result was strange and unexpected. The Bell group, instead of being driven from the field, were at once lifted to a higher level in the business world. And the Western Union, in the endeavor to protect its private lines, became involuntarily a ‘bell-wether’ to lead capitalists in the direction of the telephone.''

Even then, when financial aid came to the Bell enterprise, it was from capitalists, not from bankers, and among these capitalists was William H. Forbes (son of the builder of the Burlington) who became the first President of the Bell Telephone Company. That was in 1878. More than twenty years later, after the telephone had spread over the world, the great house of Morgan came into financial control of the property. The American Telephone & Telegraph Company was formed. The process of combination became active. Since January, 1900, its stock has increased from $25,886,300 to $344,606,400. In six years (1906 to 1912) the Morgan associates marketed about $300,000,000 bonds of that company or its subsidiaries. In that period the volume of business done by the telephone companies had, of course, grown greatly, and the plant had to be constantly increased; but the proceeds of these huge security issues were used, to a large extent, in effecting combinations; that is, in buying out telephone competitors; in buying control of the Western Union Telegraph Company; and in buying up outstanding stock interests in semi-independent Bell companies. It is these combinations which have led to the investigation of the Telephone Company by the Department of Justice; and they are, in large part, responsible for the movement to have the government take over the telephone business.

Electrical Machinery

The business of manufacturing electrical machinery and apparatus is only a little over thirty years old. J. P. Morgan & Co. became interested early in one branch of it; but their dominance of the business today is due, not to their "initiating" it, but to their effecting a combination, and organizing the General Electric Company in 1892. There were then three large electrical companies, the Thomson-Houston, the Edison and the Westinghouse, besides some small ones. The Thomson-Houston of Lynn, Massachusetts, was in many respects the leader, having been formed to introduce, among other things, important inventions of Prof. Elihu Thomson and Prof. Houston. Lynn is one of the principal shoe-manufacturing centers of America. It is within ten miles of State Street, Boston; but Thomson's early financial support came not from Boston bankers, but mainly from Lynn business men and investors; men active, energetic, and used to taking risks withtheir ownmoney. Prominent among them was Charles A. Coffin, a shoe manufacturer, who became connected with the Thomson-Houston Company upon its organization and president of the General Electric when Mr. Morgan formed that company in 1892, by combining the Thomson-Houston and the Edison. To his continued service, supported by other Thomson-Houston men in high positions, the great prosperity of the company is, in large part, due. The two companies so combined controlled probably one-half of all electrical patents then existing in America; and certainly more than half of those which had any considerable value.

In 1896 the General Electric pooled its patents with the Westinghouse, and thus competition was further restricted. In 1903 the General Electric absorbed the Stanley Electric Company, its other large competitor; and became the largest manufacturer of electric apparatus and machinery in the world. In 1912 the resources of the Company were $131,942,144. It billed sales to the amount of $89,182,185. It employed directly over 60,000 persons,—more than a fourth as many as the Steel Trust. And it is protected against "undue" competition; for one of the Morgan partners has been a director, since 1909, in the Westinghouse; the only other large electrical machinery company in America.

The Automobile

The automobile industry is about twenty years old. It is now America's most prosperous business. When Henry B. Joy, President of the Packard Motor Car Company, was asked to what extent the bankers aided in "initiating" the automobile, he replied:

"It is the observable facts of history, it is also my experience of thirty years as a business man, banker, etc., that first the seer conceives an opportunity. He has faith in his almost second sight. He believes he can do something—develop a business—construct an industry—build a railroad—or Niagara Falls Power Company,—and make it pay !

"Now the human measure is not the actual physical construction, but the `make it pay'!

"A man raised the money in the late 90s and built a beet sugar factory in Michigan. Wiseacres said it was nonsense. He gathered together the money from his friends who would take a chance with him. He not only built the sugar factory (and there was never any doubt of his ability to do that) but he made it pay. The next year two more sugar factories were built, and were financially successful. These were built by private individuals of wealth, taking chances in the face of cries of doubting bankers and trust companies.

"Once demonstrated that the industry was a sound one financially andthenbankers and trust companies would lend the new sugar companies which were speedily organized a large part of the necessary funds to construct and operate.

"The motor-car business was the same.

"When a few gentlemen followed me in my vision of the possibilities of the business, the banks and older business men (who in the main were the banks) said, ‘fools and their money soon to be parted’—etc., etc.

"Private capital at first establishes an industry, backs it through its troubles, and, if possible, wins financial success when banks would not lend a dollar of aid.

"The business once having proved to be practicable and financially successful, then do the banks lend aid to its needs."

Such also was the experience of the greatest of the many financial successes in the automobile industry—the Ford Motor Company.

How Bankers Arrest Development

But "great banking houses" have not merely failed to initiate industrial development; they have definitely arrested development because to them the creation of the trusts is largely due. The recital in the Memorial addressed to the President by the Investors' Guild in November, 1911, is significant:

"It is a well-known fact that modern trade combinations tend strongly toward constancy of process and products, and by their very nature are opposed to new processes and new products originated by independent inventors, and hence tend to restrain competition in the development and sale of patents and patent rights; and consequently tend to discourage independent inventive thought, to the great detriment of the nation, and with injustice to inventors whom the Constitution especially intended to encourage and protect in their rights."

And more specific was the testimony of theEngineering News:

"We are today something like five years behind Germany in iron and steel metallurgy, and such innovations as are being introduced by our iron and steel manufacturers are most of them merely following the lead set by foreigners years ago.

"We do not believe this is because American engineers are any less ingenious or original than those of Europe, though they may indeed be deficient in training and scientific education compared with those of Germany. We believe the main cause is the wholesale consolidation which has taken place in American industry. A huge organization is too clumsy to take up the development of an original idea. With the market closely controlled and profits certain by following standard methods, those who control our trusts do not want the bother of developing anything new.

"We instance metallurgy only by way of illustration: There are plenty of other fields of industry where exactly the same condition exists. We are building the same machines and using the same methods as a dozen years ago, and the real advances in the art are being made by European inventors and manufacturers."

To which President Wilson's statement may be added:

"I am not saying that all invention had been stopped by the growth of trusts, but I think it is perfectly clear that invention in many fields has been discouraged, that inventors have been prevented from reaping the full fruits of their ingenuity and industry, and that mankind has been deprived of many comforts and conveniences, as well as the opportunity of buying at lower prices.

"Do you know, have you had occasion to learn, that there is no hospitality for invention, now-a-days?"

Trusts and Financial Concentration

The fact that industrial monopolies arrest development is more serious even than the direct burden imposed through extortionate prices. But the most harm-bearing incident of the trusts is their promotion of financial concentration. Industrial trusts feed the money trust. Practically every trust created has destroyed the financial independence of some communities and of many properties; for it has centered the financing of a large part of whole lines of business in New York, and this usually with one of a few banking houses. This is well illustrated by the Steel Trust, which is a trust of trusts; that is, the Steel Trust combines in one huge holding company the trusts previously formed in the different branches of the steel business. Thus the Tube Trust combined 17 tube mills, located in 16 different cities, scattered over 5 states and owned by 13 different companies. The wire trust combined 19 mills; the sheet steel trust 26; the bridge and structural trust 27; and the tin plate trust 36; all scattered similarly over many states. Finally these and other companies were formed into the United States Steel Corporation, combining 228 companies in all, located in 127 cities and towns, scattered over 18 states. Before the combinations were effected, nearly every one of these companies was owned largely by those who managed it, and had been financed, to a large extent, in the place, or, in the state, in which it was located. When the Steel Trust was formed all these concerns came under one management. Thereafter, the financing of each of these 228 corporations (and some which were later acquired) had to be done through or with the consent of J. P. Morgan & Co.That was the greatest step in financial concentration ever taken.

Stock Exchange Incidents

The organization of trusts has served in another way to increase the power of the Money Trust. Few of the independent concerns out of which the trusts have been formed, were listed on the New York Stock Exchange; and few of them had financial offices in New York. Promoters of large corporations, whose stock is to be held by the public, and also investors, desire to have their securities listed on the New York Stock Exchange. Under the rules of the Exchange, no security can be so listed unless the corporation has a transfer agent and registrar in New York City. Furthermore, banker-directorships have contributed largely to the establishment of the financial offices of the trusts in New York City. That alone would tend to financial concentration. But the listing of the stock enhances the power of the Money Trust in another way. An industrial stock, once listed, frequently becomes the subject of active speculation; and speculation feeds the Money Trust indirectly in many ways. It draws the money of the country to New York. The New York bankers handle the loans of other people's money on the Stock Exchange; and members of the Stock Exchange receive large amounts from commissions. For instance: There are 5,084,952 shares of United States Steel common stock outstanding. But in the five years ending December 31, 1912, speculation in that stock was so extensive that there were sold on the Exchange an average of 29,380,888 shares a year; or nearly six times as much as there is Steel common in existence. Except where the transactions are by or for the brokers, sales on the Exchange involve the payment of twenty-five cents in commission for each share of stock sold; that is, twelve and one-half cents by the seller and twelve and one-half cents by the buyer. Thus the commission from the Steel common alone afforded a revenue averaging many millions a year. The Steel preferred stock is also much traded in; and there are 138 other industrials, largely trusts, listed on the New York Stock Exchange.

Trust Ramifications

But the potency of trusts as a factor in financial concentration is manifested in still other ways; notably through their ramifying operations. This is illustrated forcibly by the General Electric Company's control of water-power companies which has now been disclosed in an able report of the United States Bureau of Corporations:

"The extent of the General Electric influence is not fully revealed by its consolidated balance sheet. A very large number of corporations are connected with it through its subsidiaries and through corporations controlled by these subsidiaries or affiliated with them. There is a still wider circle of influence due to the fact that officers and directors of the General Electric Co. and its subsidiaries are also officers or directors of many other corporations, some of whose securities are owned by the General Electric Company.

"The General Electric Company holds in the first place all the common stock in three security holding companies: the United Electric Securities Co., the Electrical Securities Corporation, and the Electric Bond and Share Co. Directly and through these corporations and their officers the General Electric controls a large part of the water power of the United States.

. . ."The water-power companies in the General Electric group are found in 18 States. These 18 States have 2,325,757 commercial horsepower developed or under construction, and of this total the General Electric group includes 939,115 h. p. or 40.4 per cent. The greatest amount of power controlled by the companies in the General Electric group in any State is found in Washington. This is followed by New York, Pennsylvania, California, Montana, Iowa, Oregon, and Colorado. In five of the States shown in the table the water-power companies included in the General Electric group control more than 50 per cent. of the commercial power, developed and under construction. The percentage of power in the States included in the General Electric group ranges from a little less than 2 per cent. in Michigan to nearly 80 per cent. in Pennsylvania. In Colorado they control 72 per cent.; in New Hampshire 61 per cent.; in Oregon 58 per cent.; and in Washington 55 per cent.

"Besides the power developed and under construction water-power concerns included in the General Electric group own in the States shown in the table 641,600 h. p. undeveloped."

This water power control enables the General Electric group to control other public service corporations:

"The water-power companies subject to General Electric influence control the street railways in at least 16 cities and towns; the electric-light plants in 78 cities and towns; gas plants in 19 cities and towns; and are affiliated with the electric light and gas plants in other towns. Though many of these communities, particularly those served with light only, are small, several of them are the most important in the States where these water-power companies operate. The water-power companies in the General Electric group own, control, or are closely affiliated with, the street railways in Portland and Salem, Ore.; Spokane, Wash.; Great Falls, Mont. ; St. Louis, Mo. ; Winona, Minn.; Milwaukee and Racine, Wis.; Elmira, N. Y.; Asheville and Raleigh, N. C., and other relatively less important towns. The towns in which the lighting plants (electric or gas) are owned or controlled include Portland, Salem, Astoria, and other towns in Oregon; Bellingham and other towns in Washington; Butte, Great Falls, Bozeman and other towns in Montana; Leadville and Colorado Springs in Colorado; St. Louis, Mo. ; Milwaukee, Racine and several small towns in Wisconsin; Hudson and Rensselaer, N. Y.; Detroit, Mich. ; Asheville and Raleigh, N. C.; and in fact one or more towns in practically every community where developed water power is controlled by this group. In addition to the public-service corporations thus controlled by the water-power companies subject to General Electric influence, there are numerous public-service corporations in other municipalities that purchase power from the hydroelectric developments controlled by or affiliated with the General Electric Co. This is true of Denver, Colo., which has already been discussed. In Baltimore, Md., a water-power concern in the General Electric group, namely, the Pennsylvania Water & Power Co., sells 20,000 h. p. to the Consolidated Gas, Electric Light & Power Co., which controls the entire light and power business of that city. The power to operate all the electric street railway systems of Buffalo, N. Y., and vicinity, involving a trackage of approximately 375 miles, is supplied through a subsidiary of the Niagara Falls Power Co."

And the General Electric Company, through the financing of public service companies, exercises a like influence in communities where there is no water power:

"It, or its subsidiaries, has acquired control of or an interest in the public-service corporations of numerous cities where there is no water-power connection, and it is affiliated with still others by virtue of common directors… This vast network of relationship between hydro-electric corporations through prominent officers and directors of the largest manufacturer of electrical machinery and supplies in the United States is highly significant. . .

"It is possible that this relationship to such a large number of strong financial concerns, through common officers and directors, affords the General Electric Co. an advantage that may place rivals at a corresponding disadvantage. Whether or not this great financial power has been used to the particular disadvantage of any rival water-power concern is not so important as the fact that such power exists and that it might be so used at any time."

The Sherman Law

The Money Trust cannot be broken, if we allow its power to be constantly augmented. To break the Money Trust, we must stop that power at its source. The industrial trusts are among its most effective feeders. Those which are illegal should be dissolved. The creation of new ones should be prevented. To this end the Sherman Law should be supplemented both by providing more efficient judicial machinery, and by creating a commission with administrative functions to aid in enforcing the law. When that is done, another step will have been taken toward securing the New Freedom. But restrictive legislation alone will not suffice. We should bear in mind the admonition with which the Commissioner of Corporations closes his review of our water power development:

"There is . . . presented such a situation in water powers and other public utilities as might bring about at any time under a single management the control of a majority of the developed, water power in the United States and similar control over the public utilities in a vast number of cities and towns, including some of the most important in the country."

We should conserve all rights which the Federal Government and the States now have in our natural resources, and there should be a complete separation of our industries from railroads and public utilities.

Go the next chapter.

Return to the table of contents.